In a bold stride towards economic stabilization, Zimbabwe has become the first nation to adopt a gold-backed currency, the ZiG, an acronym for “Zimbabwe Gold.”

This revolutionary measure, announced by Central Bank Governor John Mushayavanhu, aims to shield the country from the severe currency fluctuations and rampant inflation that have plagued its economy for decades.

The Birth of ZiG: Zimbabwe’s Monetary Renaissance

Strategic Launch and Implementation

- Official Announcement: Governor Mushayavanhu unveiled the ZiG on a Friday, marking a historic moment in Zimbabwe’s financial landscape.

- Conversion Period: Zimbabweans are given a 21-day window to transition from the Zimbabwean dollar and the Real Time Gross Settlement (RTGS) dollar, which has depreciated significantly, to the new ZiG currency.

Key Features of the ZiG Currency

- Denominations and Forms: The ZiG will be available in various denominations—1, 2, 5, 10, 50, 100, and 200—both in banknotes and coins.

- Gold Backing: Each unit of ZiG is backed by Zimbabwe’s gold reserves, which aim to provide a stable and reliable foundation for the currency.

- Legal Tender Status: The US dollar will continue to be legal tender, accounting for 85% of transactions, alongside the new ZiG.

Economic Implications and Goals

Addressing Past Challenges

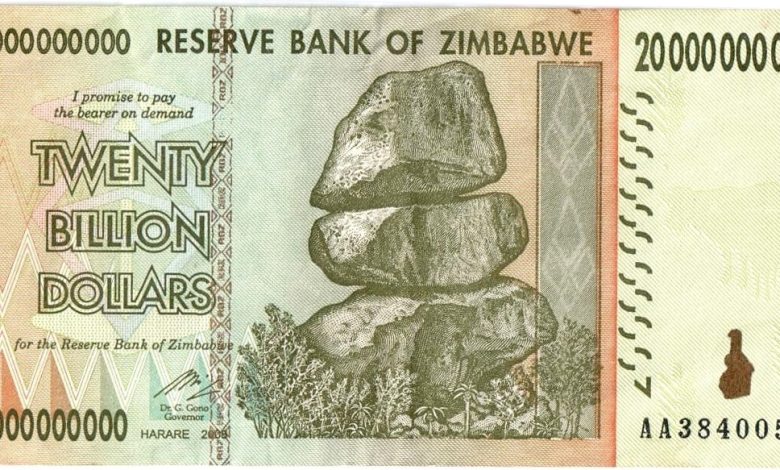

The introduction of ZiG is a response to the historical economic challenges Zimbabwe has faced, including hyperinflation and currency devaluation.

By anchoring the currency to gold, a universally valued commodity, the government seeks to restore trust and stability in its monetary system.

Supporting Infrastructure

- US Coin Shortage Solution: The introduction of ZiG coins also addresses the shortage of US coins in Zimbabwe, providing a practical solution to an issue that has seen consumers often receiving small items like sweets and pens as change.

Potential Risks and Criticisms

Sustainability Concerns

- Gold Reserve Adequacy: Experts, including economist Prosper Chitambara, have raised concerns about whether Zimbabwe’s gold reserves are sufficient to fully back the ZiG and sustain its value against potential market fluctuations.

- Comparative Analysis: Zimbabwe’s gold reserves are smaller compared to neighboring countries like South Africa, which could impact the perceived stability and confidence in the ZiG.

Global Perspective and Expert Opinions

International Response

The global financial community is keenly watching Zimbabwe’s experiment with the ZiG, as it could set a precedent for other countries dealing with similar economic issues.

Expert Analysis

- Economic Stability: Some economists argue that while the gold backing provides some security, the ultimate success of the ZiG will depend on broader economic reforms and governance.

- Market Volatility: There is also a debate on how fluctuations in global gold prices might affect the stability of the ZiG.

Future Outlook and Strategic Moves

Government’s Commitment

The Zimbabwean government has committed to maintaining a transparent and phased approach in rolling out the ZiG, aiming to build and sustain confidence among its citizens and international investors.

Monitoring and Adjustments

Continuous monitoring and necessary adjustments will be crucial as Zimbabwe navigates the initial phases of implementing its gold-backed currency.

Conclusion: A Pioneering Financial Experiment

Zimbabwe’s introduction of the ZiG represents a pioneering move in the global economic arena.

By tying its currency directly to gold, Zimbabwe is not just attempting to solve its economic instability but is also setting an innovative financial trend that could potentially influence other nations facing similar challenges.

The success of this initiative could lead to a transformative period in global economic policy making.