Zimbabwe to Tie Exchange Rates to Hard Assets

Zimbabwe is taking proactive steps to address the instability plaguing its local currency, with a focus on tying the exchange rate to tangible assets such as gold and establishing a currency board.

These measures, proposed by Finance Minister Mthuli Ncube during an online press briefing, aim to tackle the recent decline in the value of the Zimbabwean dollar, which has fallen by approximately 40% since the beginning of the year.

Proposed Measures and Government Initiatives

Exploring the Currency Stability Strategy

Minister Ncube outlined plans to link the exchange rate to hard assets like gold, emphasizing the need to manage liquidity growth and inflation effectively.

He suggested implementing a currency board system to ensure that domestic liquidity expansion is restrained by the value of the asset backing the currency. These measures, he believes, will provide a lasting solution to currency volatility.

Government’s Commitment to Stability

President Emmerson Mnangagwa’s administration has expressed its commitment to introducing a “structured currency,” although specific details on its implementation remain forthcoming.

The central bank governor has affirmed ongoing efforts to develop this proposed currency system, indicating a concerted government focus on addressing Zimbabwe’s currency challenges.

ALSO READ: Victoria Falls in Zimbabwe and Zambia’ “The Smoke that Thunders”

Historical Context: Zimbabwe’s Currency Journey

From Hyperinflation to Currency Reintroduction

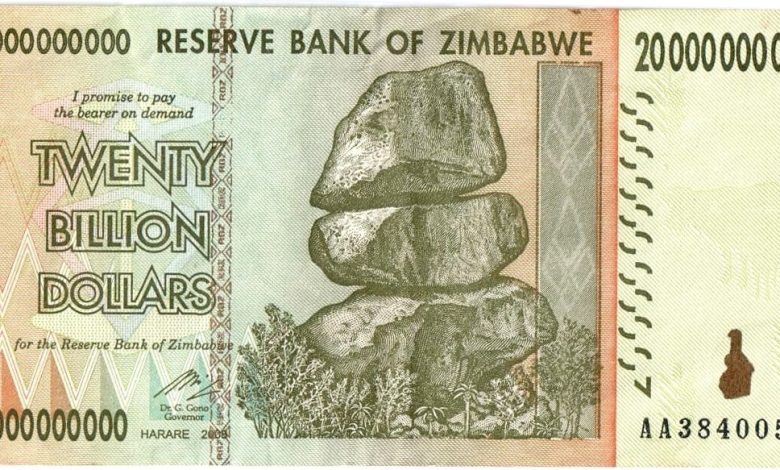

Zimbabwe’s economic history is marked by hyperinflation, particularly during the era of Robert Mugabe’s leadership.

In response to rampant inflation, the country abandoned its debilitated dollar in 2009, adopting foreign currencies like the U.S. dollar.

However, in 2019, the government reintroduced the Zimbabwean dollar in an attempt to regain monetary sovereignty.

Challenges and Failed Initiatives

Despite multiple initiatives aimed at stabilizing the currency, including the introduction of gold coins and bullion-backed digital tokens like ZiG, Zimbabwe has struggled to maintain the value of its currency.

These efforts have failed to mitigate the persistent depreciation of the Zimbabwean dollar, highlighting the complexity of the economic challenges facing the nation.

Extension of Multi-Currency System

Last year, Zimbabwe announced the extension of its multi-currency system, with the U.S. dollar serving as the anchor currency until 2030.

This decision reflects a pragmatic approach to currency management amidst ongoing economic uncertainties.

Conclusion: Pursuing Sustainable Currency Solutions

Zimbabwe’s pursuit of currency stability through measures such as tying exchange rates to gold underscores the government’s commitment to addressing economic volatility.

As the nation navigates its currency challenges, proactive initiatives and strategic interventions will be crucial in fostering sustainable economic growth and restoring confidence in the financial system.