How to Shop Worldwide with Virtual Visa and MasterCard Cards

In today’s global economy, being able to make purchases seamlessly across borders is essential. Choosing an international financial service for your transactions can save you money and hassle.

For frequent travelers and online shoppers, using a virtual card can offer unparalleled convenience and security. In this article, we’ll explore why virtual cards, particularly those from PSTNET, are an excellent choice for global shopping and more.

International financial services offer several advantages over local alternatives. They provide access to multiple currencies, lower transaction fees, and broader acceptance.

Whether you’re paying for a Netflix subscription, booking a hotel, or buying apps from Google Play or the App Store, using a virtual card from an international service like PSTNET ensures your transactions are smooth and cost-effective.

Many popular platforms accept payments primarily in US dollars, making a dollar-denominated card particularly valuable.

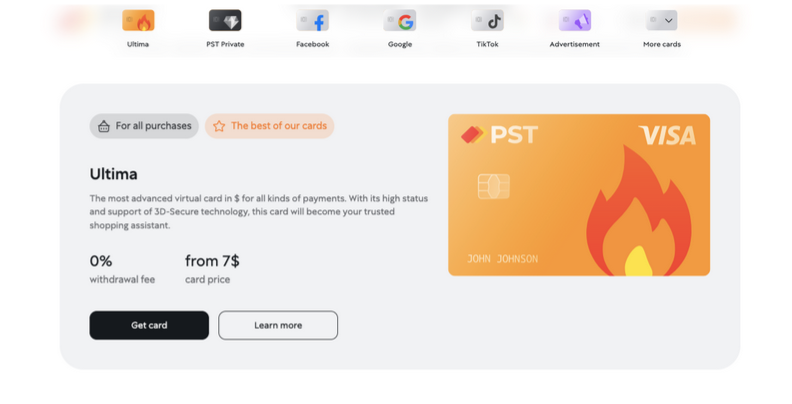

PSTNET’s Ultima Virtual Card

PSTNET is a financial platform that offers a variety of virtual multi-currency cards, including the Ultima — the best virtual card for shopping.

This Visa/MasterCard is perfect for standard shopping needs but also offers segmented cards for specific purposes like paying for advertising on popular platforms.

Security is a major concern for online transactions. PSTNET uses 3D Secure technology to protect your payments. This technology requires a verification step for each transaction, usually in the form of a code sent via SMS or through a secure app.

This extra layer of security significantly reduces the risk of fraud, giving you peace of mind when making purchases.

People around the world have left overwhelmingly positive PSTNET reviews, highlighting several attractive features. They appreciate the lack of restrictions on spending and top-ups, as well as the absence of fees for payments.

Key Features of The “Ultima” Cards

- Easy Top-Ups: You can fund your card using various methods, including cryptocurrencies (USDT TRC20, BTC, and 15+ other coins), SWIFT bank transfers, SEPA, or another Visa/MasterCard.

- No Limits on Spending and Top-Ups: This flexibility allows you to use your card for any amount, anytime.

- No Transaction Fees: There are no fees for transactions, making it a cost-effective solution for frequent users.

- Low Top-Up Fees: The top-up fee is just 2%, one of the lowest in the market.

- Simple Registration: You can register using Google, Telegram, WhatsApp, or even your Apple account. The first card can be issued without needing to submit documents.

- Free Card Options: You can get free cards if your monthly spending meets certain thresholds.

- Efficient Support: PSTNET offers 24/7 customer support through various channels, ensuring you always have help when you need it.

- Functional Telegram Bot: The bot sends notifications and 3D Secure codes directly to your Telegram, streamlining your transaction process.

Why Choose Virtual Cards with No Spending or Top-Up Limits?

Virtual cards with no spending or top-up limits are incredibly versatile. They allow you to:

- Shop online without worrying about exceeding a cap.

- Pay for services like streaming subscriptions, app stores, and even advertising on platforms like TikTok, Google, and Facebook.

- Book travel accommodations, cruises, and other services without restrictions.

A virtual card without spending limits ensures you can manage all these expenses from a single card, simplifying your financial management.

Conclusion

For those looking to shop globally, a virtual card like PSTNET’s Ultima offers unmatched convenience, security, and flexibility.

With no spending limits, minimal fees, and robust security features, it is an ideal solution for both everyday purchases and specialized needs like paying for online advertising. By choosing an international financial service like PSTNET, you ensure that your financial transactions are efficient, secure, and cost-effective, making global shopping a breeze.